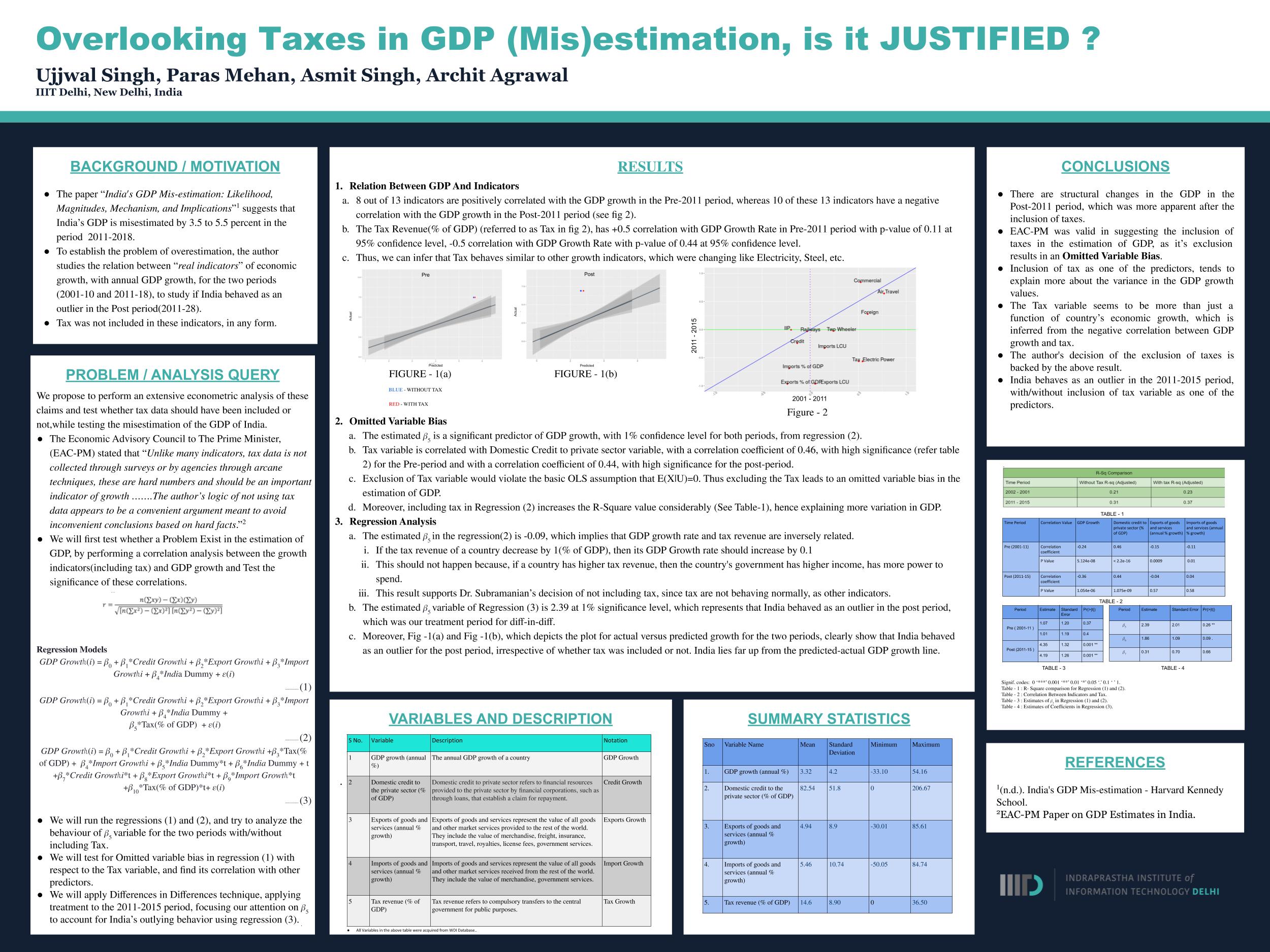

We propose to perform an extensive econometric analysis of these claims and test whether tax data should have been included or not included while testing the misestimation of the GDP of India. The Economic Advisory Council to the Prime Minister (EAC-PM) in its rebuttal 4 to Arvind Subramanian paper 1 stated that : “ Unlike many indicators, tax data is not collected through surveys or by agencies through arcane techniques, these are hard numbers and should be an important indicator of growth. Further, there have been no major changes in tax laws until the end period in the author’s analysis (31st March 2017). GST was introduced on 1st July 2017. The author’s logic of not using tax data appears to be a convenient argument meant to avoid inconvenient conclusions based on hard facts . ” The EAC-PM raised concerns over the fact that Arvind Subramanian didn’t include taxes in his study 1 , but as stated, taxes are “ hard numbers and should be an important indicator of growth. ” EAC-PM also argues that the tax plays an essential role in the GDP growth rate of the country, and should be considered as one of the fundamental indicators of growth of a country. Therefore, we propose to perform an extensive econometric analysis of these claims and test whether tax should have been included or not included while testing the misestimation of the GDP of India.

Please look at 'Report.pdf' for further deatails.

Teammates : Paras Mehan[parasmehan123] ; Ujjwal Singh[ujjwalll] ; Archit Aggarwal[nahimilega]