Name

移动均线交叉趋势追踪策略Moving-Average-Crossover-Trend-Following-Strategy

Author

ChaoZhang

Strategy Description

移动均线交叉趋势追踪策略是一种追踪市场趋势的量化交易策略。该策略通过计算快速移动均线和慢速移动均线,并在它们发生交叉时生成交易信号,以捕捉市场趋势的转折点。

该策略的核心原理是使用不同参数的指数移动均线(EMA)实现对市场趋势的判断。策略中定义了一个快速EMA和一个慢速EMA。当快速EMA从下方上穿慢速EMA时,表示市场趋势转bull;当快速EMA从上方下穿慢速EMA时,表示市场趋势转bear。

在上穿时,策略会开多单,在下穿时,策略会开空单。策略会一直持有仓位,直到止盈止损触发或者再次发生交叉反向信号。

该策略具有以下优势:

- 策略逻辑简单清晰,容易理解实现,适合初学者学习;

- 利用EMA平滑价格,可以有效过滤市场Noise,识别趋势;

- 可以灵活调整参数,适应不同周期的市场;

- 可以将策略扩展为多时间周期版本,提高稳定性。

该策略也存在一些风险:

- 在震荡行情中,可能出现多次止损,影响盈利;

- 无法有效识别趋势类型(牛熊),可能亏损严重;

- EMA参数设置不当,会导致交易频率过高或识别延迟。

为了降低风险,可以考虑结合其他指标判断趋势类型,或者设置止损比例更宽松一些。

该策略还可以从以下几个方面进行优化:

- 增加对趋势类型的判断,避免反向开仓;

- 增加多时间周期判断,提高信号质量;

- 动态调整止损止盈比例,优化退出点;

- 结合其他指标过滤信号,减少误差交易。

移动均线交叉趋势追踪策略整体来说是一种简单实用的趋势交易策略。该策略核心思想清晰,易于实践,同时也存在一定的优化空间。通过参数调整、多周期判断、动态止损等方式,可以不断提升策略的稳定性和盈利水平。

||

The Moving Average Crossover Trend Following strategy is a quantitative trading strategy that tracks market trends. The strategy generates trading signals by calculating fast and slow moving averages and catching turning points in market trends when crossovers occur.

The core principle of this strategy is to judge market trends using exponential moving averages (EMAs) with different parameters. The strategy defines a fast EMA and a slow EMA. When the fast EMA crosses above the slow EMA, it indicates a bullish trend reversal in the market. When the fast EMA crosses below the slow EMA, it indicates a bearish trend reversal.

On upward crosses, the strategy will open long positions. On downward crosses, the strategy will open short positions. The strategy will hold its position until take profit or stop loss is triggered, or a crossover in the opposite direction occurs again.

The strategy has the following advantages:

- The strategy logic is simple and clear, easy to understand and implement, suitable for beginners;

- Using EMAs to smooth prices can effectively filter out market noise and identify trends;

- Parameters can be flexibly adjusted to adapt to markets with different cycles;

- The strategy can be extended to multi-timeframe versions to improve stability.

The strategy also has some risks:

- In ranging markets, multiple stop losses may occur, impacting profitability;

- It cannot effectively identify trend types (bullish or bearish), which may lead to severe losses;

- Improper EMA parameter settings may lead to over-trading or detection delays.

To mitigate risks, consider combining other indicators to determine trend types, or set wider stop loss ratios.

The strategy can also be optimized in the following aspects:

- Increase judgment of trend types to avoid opening positions against the trend;

- Add multi-timeframe judgments to improve signal quality;

- Dynamically adjust stop loss and take profit ratios to optimize exit points;

- Combine other indicators to filter out erroneous trades.

In summary, the Moving Average Crossover Trend Following Strategy is a simple and practical trend trading strategy. The core ideas of the strategy are clear and easy to implement, and there is also room for optimization. By adjusting parameters, adding multi-timeframe analysis, dynamic stops etc, the stability and profitability of the strategy can be continuously improved.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | 10 | Fast EMA |

| v_input_int_2 | 20 | Slow EMA |

| v_input_string_1 | 0 | Trade Direction: Both |

| v_input_1 | timestamp(01 Jan 2023 00:00) | Start Date |

| v_input_2 | timestamp(31 Dec 2030 23:59) | End Date |

| v_input_3 | true | Take Profit Percent |

| v_input_4 | true | Stop Loss Percent |

Source (PineScript)

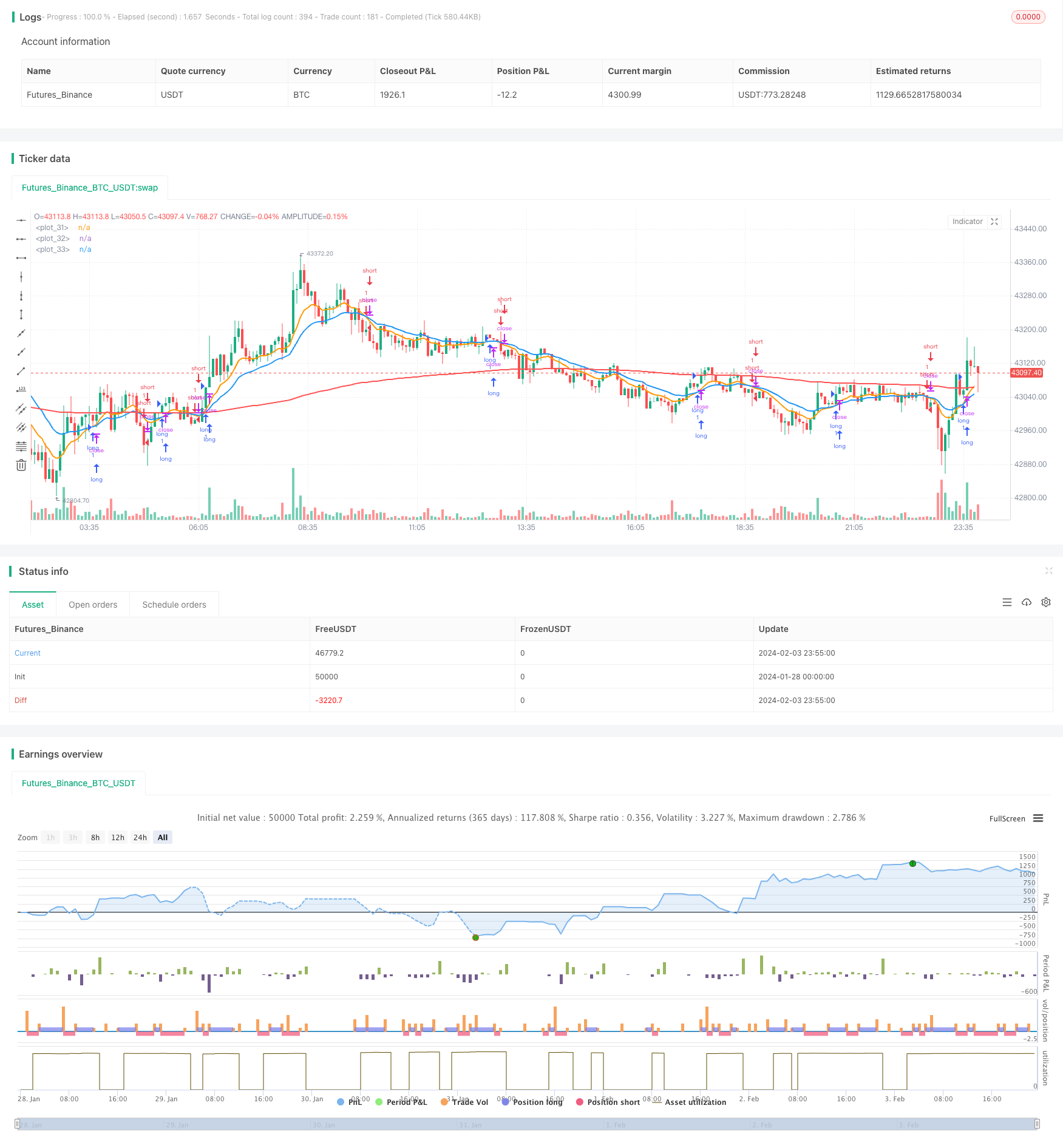

/*backtest

start: 2024-01-28 00:00:00

end: 2024-02-04 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Zhukov trade', overlay=true, calc_on_every_tick=true, currency=currency.USD)

// INPUT:

// Options to enter fast and slow Exponential Moving Average (EMA) values

emaFast = input.int(title='Fast EMA', defval=10, minval=1, maxval=9999)

emaSlow = input.int(title='Slow EMA', defval=20, minval=1, maxval=9999)

// Option to select trade directions

tradeDirection = input.string(title='Trade Direction', options=['Long', 'Short', 'Both'], defval='Both')

// Options that configure the backtest date range

startDate = input(title='Start Date', defval=timestamp('01 Jan 2023 00:00'))

endDate = input(title='End Date', defval=timestamp('31 Dec 2030 23:59'))

// Set take profit and stop loss percentages

take_profit_percent = input(1.0, title ="Take Profit Percent") / 100.0

stop_loss_percent = input(1.0, title ="Stop Loss Percent") / 100.0

// CALCULATIONS:

// Use the built-in function to calculate two EMA lines

fastEMA = ta.ema(close, emaFast)

slowEMA = ta.ema(close, emaSlow)

emapos = ta.ema(close, 200)

// PLOT:

// Draw the EMA lines on the chart

plot(series=fastEMA, color=color.new(color.orange, 0), linewidth=2)

plot(series=slowEMA, color=color.new(color.blue, 0), linewidth=2)

plot(series=emapos, color=color.new(color.red, 0), linewidth=2)

// CONDITIONS:

// Check if the close time of the current bar falls inside the date range

inDateRange = true

// Translate input into trading conditions

longOK = tradeDirection == 'Long' or tradeDirection == 'Both'

shortOK = tradeDirection == 'Short' or tradeDirection == 'Both'

// Decide if we should go long or short using the built-in functions

longCondition = ta.crossover(fastEMA, slowEMA) and inDateRange

shortCondition = ta.crossunder(fastEMA, slowEMA) and inDateRange

// ORDERS:

// Submit entry (or reverse) orders

if longCondition and longOK

strategy.entry(id='long', direction=strategy.long)

if shortCondition and shortOK

strategy.entry(id='short', direction=strategy.short)

// Exit orders

if strategy.position_size > 0 and longOK

strategy.exit(id='exit long', from_entry='long', limit=strategy.position_avg_price * (1 + take_profit_percent), stop=strategy.position_avg_price * (1 - stop_loss_percent))

if strategy.position_size < 0 and shortOK

strategy.exit(id='exit short', from_entry='short', limit=strategy.position_avg_price * (1 - take_profit_percent), stop=strategy.position_avg_price * (1 + stop_loss_percent))

Detail

https://www.fmz.com/strategy/441080

Last Modified

2024-02-05 14:12:27