Name

基于RSI和VWAP的短线量化策略RSI-VWAP-Short-term-Quant-Strategy

Author

ChaoZhang

Strategy Description

本策略命名为“RSI-VWAP短线策略”。该策略采用RSI指标和成交量加权平均价(VWAP)作为技术指标,设定多空头信号,进而产生买卖决策。策略追求在短线上捕捉市场的超买超卖现象,以期获得超额收益。

- 使用RSI指标判断市场是否处于超买或超卖状态。RSI指标值高于80为超买区,低于20为超卖区。

- RSI指标使用VWAP而不是收盘价作为源数据。VWAP更能反映当日的平均成交价。

- 当RSI指标值从超卖区上穿20时产生买入信号。当RSI指标值从超买区下穿80时产生卖出信号。

- 本策略只做多头,不做空头。即只在超卖买入,超买卖出。

- 使用VWAP作为RSI的数据源,使RSI指标对市场的判断更准确,避免被假突破误导。

- 只做多头,降低操作频率,有利于获得长期稳定收益。

- RSI指标参数为17,适合短线操作。

- 采用期望交易次数不高的短线操作方式,降低交易成本,有利于获得更高收益率。

- 量化策略回测存在过拟合风险,实盘结果可能与回测不符。

- 只做多头无法及时抓住下跌行情的机会。

- 超买超卖判断标准可能不适合所有品种,需要针对不同品种调整参数。

- 任何技术指标都可能产生错误信号,无法完全避免亏损的发生。

可通过适当放宽超买超卖标准、结合其他指标确认信号、调整参数区间等方法降低风险。

- 测试不同参数对策略效果的影响,优化RSI长度和超买超卖阈值。

- 增加止损策略,通过移动止损、时间止损等方式锁定部分盈利,降低回撤。

- 结合其他指标进行信号过滤,提高信号准确率。

- 根据不同品种特点设定独立的参数区间,使策略能更好适应不同品种。

该策略总体而言是一个简单实用的短线策略。使用VWAP使RSI指标判断更准确,只做多头降低操作频率。策略思路清晰,易于理解和实现,适合量化交易的入门。但任何单一指标策略都难以完美,仍需不断优化使其产生更好的实盘效果。

||

This strategy is named "RSI-VWAP Short-term Strategy". It uses the RSI indicator and Volume Weighted Average Price (VWAP) as technical indicators to generate long and short signals and thus make buy and sell decisions. The strategy aims to capture the overbought and oversold phenomena in the short-term market in order to achieve excess returns.

- Use the RSI indicator to determine if the market is overbought or oversold. RSI values above 80 indicate an overbought area and below 20 indicate an oversold area.

- The RSI indicator uses VWAP instead of closing price as source data. VWAP reflects the average trading price of the day better.

- A buy signal is generated when the RSI crosses up through 20 from the oversold area. A sell signal is generated when the RSI crosses down through 80 from the overbought area.

- This strategy only goes long and does not go short. That is, only buy in oversold and sell in overbought.

- Using VWAP as the data source for RSI makes the RSI indicator judge the market more accurately, avoiding being misled by false breakouts.

- Only going long reduces trading frequency and helps obtain long-term stable returns.

- The RSI parameter is 17, which is suitable for short-term operations.

- The low frequency trading method expects fewer trades, reducing transaction costs and helping obtain higher return rates.

- There is overfitting risk in quant strategy backtesting and actual results may differ from backtest.

- Unable to seize opportunities in downtrends by only going long.

- The overbought and oversold criteria may not suit all products, parameters need to be adjusted for different products.

- Any technical indicator can generate false signals and losses can not be completely avoided.

Risks can be reduced by appropriately relaxing overbought and oversold criteria, combining other indicators to confirm signals, adjusting parameter ranges, etc.

- Test the effects of different parameters on strategy performance and optimize RSI length and overbought/oversold thresholds.

- Add stop loss strategies to lock in some profits through moving stop loss, time stop loss etc, reducing drawdowns.

- Filter signals by combining other indicators to improve signal accuracy.

- Set independent parameter ranges according to characteristics of different products so that the strategy can better suit different products.

Overall this is a simple and practical short-term strategy. Using VWAP makes RSI judgement more accurate, only going long reduces trading frequency. The strategy idea is clear and easy to understand and implement, suitable for quant trading beginners. But any single indicator strategy can hardly be perfect and needs constant optimization for better live performance.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_1 | true | RSI VOLUME WEIGHTED AVERAGE PRICE |

| v_input_2 | 17 | RSI-VWAP LENGTH |

| v_input_3 | 19 | RSI-VWAP OVERSOLD |

| v_input_4 | 80 | RSI-VWAP OVERBOUGHT |

Source (PineScript)

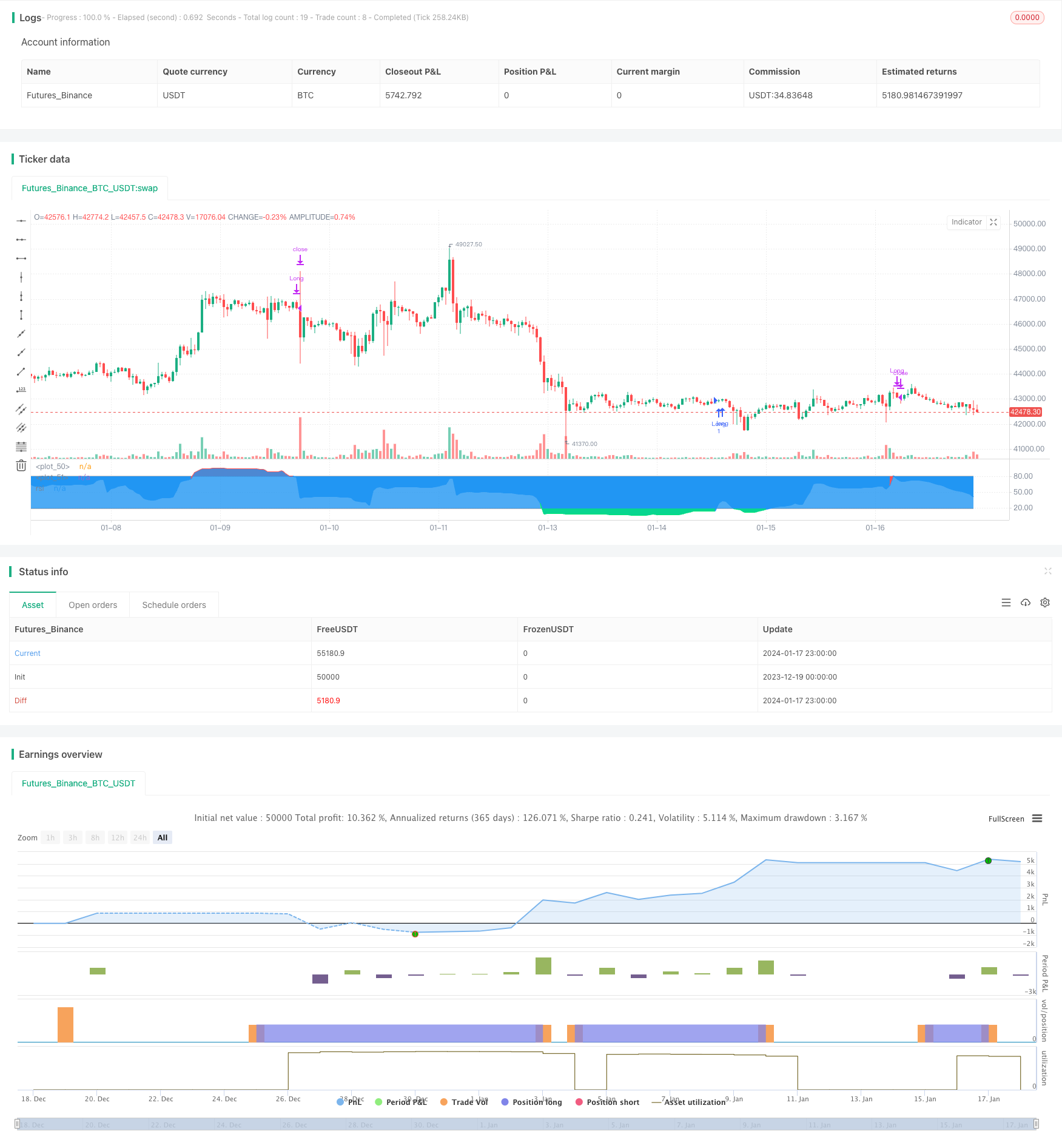

/*backtest

start: 2023-12-19 00:00:00

end: 2024-01-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Xaviz

//#####©ÉÉÉɶN###############################################

//####*..´´´´´´,,,»ëN########################################

//###ë..´´´´´´,,,,,,''%©#####################################

//###'´´´´´´,,,,,,,'''''?¶###################################

//##o´´´´´´,,,,,,,''''''''*©#################################

//##'´´´´´,,,,,,,'''''''^^^~±################################

//#±´´´´´,,,,,,,''''''''^í/;~*©####æ%;í»~~~~;==I±N###########

//#»´´´´,,,,,,'''''''''^;////;»¶X/í~~/~~~;=~~~~~~~~*¶########

//#'´´´,,,,,,''''''''^^;////;%I^~/~~/~~~=~~~;=?;~~~~;?ë######

//©´´,,,,,,,''''''''^^~/////X~/~~/~~/~~»í~~=~~~~~~~~~~^;É####

//¶´,,,,,,,''''''''^^^;///;%;~/~~;í~~»~í?~?~~~?I/~~~~?*=íÑ###

//N,,,,,,,'''''''^^^^^///;;o/~~;;~~;£=»í»;IX/=~~~~~~^^^^'*æ##

//#í,,,,,''''''''^^^^^;;;;;o~»~~~~íX//~/»~;í?IíI»~~^/*?'''=N#

//#%,,,'''''''''^^^^^^í;;;;£;~~~//»I»/£X/X/»í*&~~~^^^^'^*~'É#

//#©,,''''''''^^^^^^^^~;;;;&/~/////*X;í;o*í»~=*?*===^'''''*£#

//##&''''''''^^^^^^^^^^~;;;;X=í~~~»;;;/~;í»~»±;^^^^^';=''''É#

//##N^''''''^^^^^^^^^^~~~;;;;/£;~~/»~~»~~///o~~^^^^''''?^',æ#

//###Ñ''''^^^^^^^^^^^~~~~~;;;;;í*X*í»;~~IX?~~^^^^/?'''''=,=##

//####X'''^^^^^^^^^^~~~~~~~~;;íííííí~~í*=~~~~Ií^'''=''''^»©##

//#####£^^^^^^^^^^^~~~~~~~~~~~íííííí~~~~~*~^^^;/''''='',,N###

//######æ~^^^^^^^^~~~~~~~~~~~~~~íííí~~~~~^*^^^'=''''?',,§####

//########&^^^^^^~~~~~~~~~~~~~~~~~~~~~~~^^=^^''=''''?,íN#####

//#########N?^^~~~~~~~~~~~~~~~~~~~~~~~~^^^=^''^?''';í@#######

//###########N*~~~~~~~~~~~~~~~~~~~~~~~^^^*'''^='''/É#########

//##############@;~~~~~~~~~~~~~~~~~~~^^~='''~?'';É###########

//#################É=~~~~~~~~~~~~~~^^^*~'''*~?§##############

//#####################N§£I/~~~~~~»*?~»o§æN##################

//@version=4

strategy("RSI-VWAP INDICATOR", overlay=false)

// ================================================================================================================================================================================

// RSI VWAP INDICATOR

// ================================================================================================================================================================================

// Initial inputs

Act_RSI_VWAP = input(true, "RSI VOLUME WEIGHTED AVERAGE PRICE")

RSI_VWAP_length = input(17, "RSI-VWAP LENGTH")

RSI_VWAP_overSold = input(19, "RSI-VWAP OVERSOLD", type=input.float)

RSI_VWAP_overBought = input(80, "RSI-VWAP OVERBOUGHT", type=input.float)

// RSI with VWAP as source

RSI_VWAP = rsi(vwap(close), RSI_VWAP_length)

// Plotting, overlay=false

r=plot(RSI_VWAP, color = RSI_VWAP > RSI_VWAP_overBought ? color.red : RSI_VWAP < RSI_VWAP_overSold ? color.lime : color.blue, title="rsi", linewidth=2, style=plot.style_line)

h1=plot(RSI_VWAP_overBought, color = color.gray, style=plot.style_stepline)

h2=plot(RSI_VWAP_overSold, color = color.gray, style=plot.style_stepline)

fill(r,h1, color = RSI_VWAP > RSI_VWAP_overBought ? color.red : na, transp = 60)

fill(r,h2, color = RSI_VWAP < RSI_VWAP_overSold ? color.lime : na, transp = 60)

// Long only Backtest

strategy.entry("Long", strategy.long, when = (crossover(RSI_VWAP, RSI_VWAP_overSold)))

strategy.close("Long", when = (crossunder(RSI_VWAP, RSI_VWAP_overBought)))

Detail

https://www.fmz.com/strategy/439345

Last Modified

2024-01-19 14:21:15