Name

基于移动均线的金叉死叉策略EMA-Candle-Close-Strategy

Author

ChaoZhang

Strategy Description

该策略基于移动均线的金叉死叉原理制定交易信号。它融合了短期、中期和长期三条不同参数设置的移动均线,通过比较这三条均线的高低关系判断市场的多空状态,产生交易信号。

该策略设置了3条移动平均线,分别是一段短期的简单移动平均线、一段中期的权重移动平均线和一段长期的指数移动平均线。具体来说,分别设置了长度为1的SMA线、长度为20的WMA线和长度为25的EMA线。

当短期SMA线上穿中期WMA线而收盘价又高于WMA线时,说明市场由下向上反转,形成多头信号;当短期SMA线下穿中期WMA线或收盘价低于WMA线时,则为空头信号。所以,该策略通过比较三条均线的高低和交叉情况判断市场的多空状态。

该策略结合短、中、长三条不同均线,能对不同周期的市场变化做出反应,提高捕捉趋势的准确性。特别是中期的WMA具有更好的去噪波动的效果,可以有效过滤错信号。另外,该策略仅在SMA和收盘价的多头信号达成高度一致性时才发出建仓信号,这避免了whipsaws,确保每次入场的效率。

该策略可能存在误报风险。当短期SMA产生误差信号时,由于该策略严格依赖SMA线的信号,可能导致不必要的亏损。此外,该策略对参数比较敏感,当市场进入震荡区间而参数设置不当时,会产生大量的错误交易。

为防范这些风险,建议调整均线的长度,适当放宽交易条件,并设置止损来控制单笔损失。当市场趋势不明显时,也可以暂时停止策略交易。

该策略可以从以下几个方面进行优化:

-

增加更多类型的均线指标,如KC线等,形成指标集合,提高判断准确性

-

增加成交量的因素,如放量突破

-

结合波动率指标,避免震荡行情的失效

-

采用机器学习等手段对参数进行训练和优化

该策略根据三条均线的交叉和收盘价的实时关系判断市场多空状态,简单可靠。它结合了不同长度区间的均线,能有效发现趋势,信号质量较高。通过适当调整参数及引入更多辅助指标,该策略可以进一步增强针对性和稳定性。

||

This strategy generates trading signals based on the golden cross and dead cross of moving averages. It incorporates three moving averages with different parameter settings - short-term, medium-term and long-term ones. By comparing the height relationship among these three MAs, it determines the bullish/bearish state of the market and produces trading signals.

The strategy sets three moving average lines, which are a short-term simple moving average, a medium-term weighted moving average and a long-term exponential moving average. Specifically, it sets a 1-period SMA, a 20-period WMA and a 25-period EMA.

When the short-term SMA line crosses over the medium-term WMA line upwardly and the closing price is also higher than the WMA line, it indicates the market is reversing upward and forms a bullish signal. When the short-term SMA crosses below the medium-term WMA or the closing price is lower than the WMA, it gives a bearish signal. Therefore, this strategy judges the bullish/bearish state of the market by comparing the height and crossover among the three MAs.

The strategy incorporates three MAs of short, medium and long terms, which can react to market changes in different cycles and improve the accuracy of capturing trends. Especially, the medium-term WMA has a better effect of filtering out market noise and avoids wrong signals effectively. In addition, the strategy only sends long signals when the bullish signals of SMA and closing price reach high consistency, which prevents whipsaws and ensures every entry efficient.

The strategy has the risk of false signals. When the short-term SMA produces wrong signals, unnecessary losses may be caused due to the strategy’s strict dependence on the SMA line. Also, the strategy is sensitive to parameters. When parameters are set improperly under range-bound markets, many wrong trades can be triggered.

To prevent such risks, it’s suggested to adjust the MA lengths, properly loosen trading conditions and set stop loss to limit single loss. When the market trend is unclear, the strategy can be stopped temporarily.

The strategy can be optimized from the following aspects:

-

Incorporate more types of MAs like KC to form an indicator portfolio to improve accuracy

-

Add volume factors like breakout with high volume

-

Combine volatility indicators to avoid failure in choppy markets

-

Employ machine learning to train and optimize parameters

The strategy determines market bullish/bearish status based on the crossover and height relationship among three MAs and closing prices. By combining MAs of different terms, it can effectively discover trends and the signals are of high quality. With proper parameter tuning and introducing more auxiliary indicators, the strategy can be further enhanced in pertinence and stability.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_int_1 | true | SMA #1 Length |

| v_input_1_close | 0 | SMA Source #1: close |

| v_input_int_2 | 20 | HMA #2 Length |

| v_input_2_close | 0 | HMA Source #2: close |

| v_input_int_3 | 25 | EMA #3 Length |

| v_input_3_close | 0 | EMA Source #3: close |

| v_input_4 | 55 | Period Look Back |

| v_input_5 | 40 | Short Length |

| v_input_6 | 80 | Long Length |

Source (PineScript)

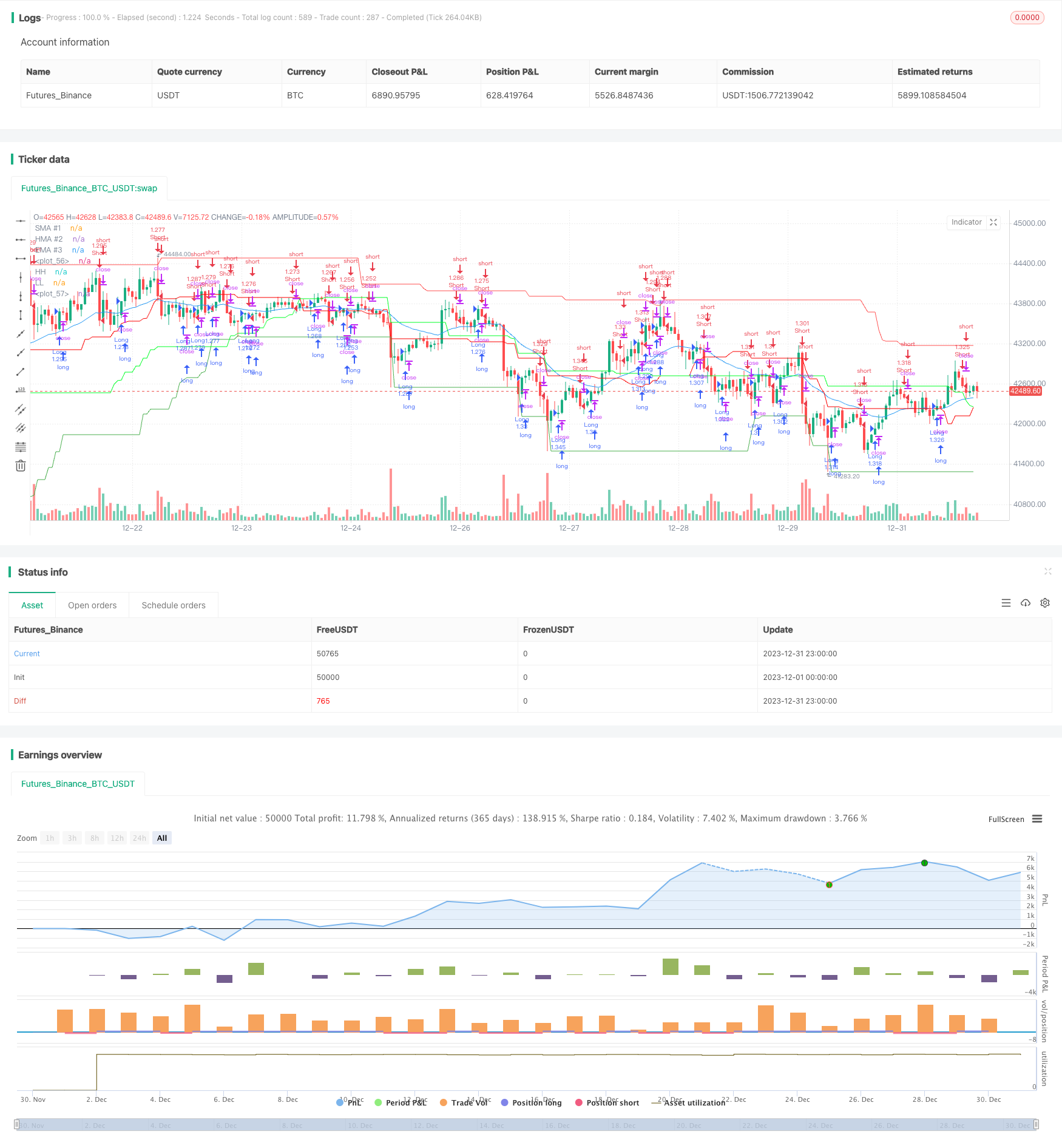

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("EMA Candle Close Strategy KHANH 11/11/2023", overlay=true, initial_capital=100, commission_type=strategy.commission.percent, commission_value=0.0000005, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

len1 = input.int(1, title="SMA #1 Length", minval=1)

src1 = input(close, title="SMA Source #1")

out1 = ta.sma(src1, len1)

plot(out1, title="SMA #1", color=close >= out1 ? color.rgb(120, 123, 134, 100) : color.rgb(120, 123, 134, 100), linewidth=1)

len2 = input.int(20, title="HMA #2 Length", minval=1)

src2 = input(close, title="HMA Source #2")

out2 = ta.hma(src2, len2)

plot(out2, title="HMA #2", color=close >= out2 ? color.rgb(253, 255, 254, 100) : color.rgb(255, 255, 255, 100), linewidth=1)

len3 = input.int(25, title="EMA #3 Length", minval=1)

src3 = input(close, title="EMA Source #3")

out3 = ta.ema(src3, len3)

plot(out3, title="EMA #3", color=close >= out3 ? color.blue : color.blue, linewidth=1)

// Define the long condition

longCondition = (out1 > out2 and close > out2)

// Define the short condition

shortCondition = (out1 < out2 or close < out2)

// Entry conditions

if (longCondition)

strategy.entry("Long",strategy.long)

else if (shortCondition)

strategy.entry("Short", strategy.short)

// Trade channel plot

PeriodLookBack = input(55, title="Period Look Back")

xHighest55 = request.security(syminfo.tickerid, timeframe.period, ta.highest(PeriodLookBack))

xLowest55 = request.security(syminfo.tickerid, timeframe.period, ta.lowest(PeriodLookBack))

plot(xHighest55[1], color=color.red, title="HH")

plot(xLowest55[1], color=color.green, title="LL")

//@version=5

//indicator("Custom Moving Averages", shorttitle="CMA", overlay=true)

shortLength = input(defval=40, title="Short Length")

longLength = input(defval=80, title="Long Length")

// Sử dụng khung thời gian của biểu đồ đang sử dụng thay vì cố định là "D"

shortTopBorder = request.security(syminfo.tickerid, timeframe.period, ta.highest(high, shortLength))

shortBottomBorder = request.security(syminfo.tickerid, timeframe.period, ta.lowest(low, shortLength))

longTopBorder = request.security(syminfo.tickerid, timeframe.period, ta.highest(high, longLength))

longBottomBorder = request.security(syminfo.tickerid, timeframe.period, ta.lowest(low, longLength))

shortAverageLine = (shortTopBorder + shortBottomBorder) / 2

longAverageLine = (longTopBorder + longBottomBorder) / 2

plot(shortAverageLine, color=color.new(#fc0000, 0))

plot(longAverageLine, color=color.new(#01ff27, 0))

Detail

https://www.fmz.com/strategy/440362

Last Modified

2024-01-29 16:02:08