Name

动量趋势同步策略RMI-Trend-Sync-Strategy

Author

ChaoZhang

Strategy Description

[trans]

动量趋势同步策略通过整合相对动量指数(RMI)和超级趋势指标的优势,实现了动量分析和趋势判断的有效结合。该策略同时关注价格变化趋势和市场动量水平,从更全面的角度判断市场走向。

RMI是相对强度指数(RSI)的改进版本。它融合了价格变化的方向性、幅度等更多特征,能更准确判断市场动量。

RMI的计算方式是:先计算一定周期内的平均涨幅和平均跌幅。与RSI不同的是,RMI使用当日收盘价相对前一日收盘价的变化值,而不是简单的正增长和负增长。然后将平均涨幅除以平均跌幅,再进行归一化处理,使值落在0-100区间。

本策略使用RMI与MFI的均值,与预设的正动量阈值和负动量阈值进行比较,判断当前市场动量水平,以此来决定建仓与平仓。

超级趋势指标基于更高时间周期计算,能提供对大趋势的判断。它会根据真实波幅ATR动态调整参数,从而有效识别趋势转折点。

本策略还加入了交易量加权均线VWMA,进一步增强了识别重要趋势转变的能力。

本策略可以选择做多、做空或双向交易。这使得交易者可以根据自己的市场观点和风险偏好进行灵活调整。

相比单一使用动量指标或趋势指标的策略,本策略通过整合RMI和超级趋势指标的优势,实现了更准确的市场走势判断。

应用不同周期的RMI和超级趋势指标,使得对短期和长期趋势的把握更加到位。

基于超级趋势的实时止损机制,可以有效控制单笔亏损。

做多、做空或双向交易的选择,使该策略可以适应不同的市场环境。

RMI和超级趋势等参数的优化复杂,不当設定可能影响策略效果。

对小周期的市场波动过于敏感,会造成止损过于频繁的问题。

解决方法:适当放宽止损范围,或采用其他震荡型止损方式。

扩大适用的品种范围,识别不同品种的参数优化方向。使策略能够在更多市场中进行复制。

加入动态止损方式,使止损线能更好跟踪当前波段,减少小震荡造成的过度止损。

结合更多指标判断作为过滤条件,避免在无明确信号的情况下建仓。

该策略通过RMI和超级趋势指标的巧妙结合,实现了准确的市场状态判断。在控制风险方面也较为出色。通过深入优化,相信其在多品种和多周期上的表现会越来越出色。 ||

The RMI Trend Sync strategy effectively combines the strengths of the Relative Momentum Index (RMI) and the Super Trend indicator to realize the integration of momentum analysis and trend judgment. By concurrently monitoring price change trends and market momentum levels, the strategy determines market trends from a more comprehensive perspective.

RMI is an enhanced version of the Relative Strength Index (RSI). It incorporates more features of price changes such as directionality and magnitude to more precisely gauge market momentum.

The RMI calculation method is: first calculate the average gain and average loss over a certain period. Unlike RSI, RMI uses the change between the current closing price and the previous closing price, rather than simple positive and negative growth. Then divide the average gain by the average loss and normalize the value to fit within a 0-100 scale.

This strategy uses the mean value of RMI and MFI to compare with preset positive momentum and negative momentum thresholds to determine the current market momentum level for entry and exit decisions.

The Super Trend indicator is calculated based on a higher timeframe, which can provide judgments on major trends. It dynamically adjusts parameters based on the true volatility ATR to effectively identify trend reversals.

This strategy also incorporates the Volume Weighted Moving Average (VWMA) to further enhance its capability to detect important trend shifts.

This strategy allows choosing long, short or two-way trading. This flexibility enables traders to adapt to their market views and risk appetite.

Compared with strategies relying solely on momentum or trend indicators, this strategy realizes more accurate market trend identification through integrating the strengths of RMI and Super Trend.

The application of RMI and Super Trend in different timeframes leads to a more appropriate grasp of both short-term and long-term trends.

The real-time stop loss mechanism based on the Super Trend can effectively limit per trade loss.

The choice among long, short or two-way trading allows this strategy to adapt to different market environments.

The optimization for parameters like RMI and Super Trend is quite complex. Inappropriate settings may undermine strategy performance.

Being overly sensitive to small fluctuations may result in excessive stop loss triggers.

Solution: Appropriately loosen the stop loss range or adopt other volatility-based stop loss methods.

Expanding applicable assets and identifying parameter optimization directions for different assets, to enable broader replication across more markets.

Incorporate dynamic stop loss mechanisms to better track current swing waves and reduce excessive stop loss caused by minor retracements.

Add judgments from more indicators as filter conditions to avoid entering positions without clear signals.

Through the ingenious combination of RMI and Super Trend, this strategy realizes accurate market condition judgments. It also excels in risk control. With in-depth optimization, it is believed that its performance across more assets and timeframes will become increasingly remarkable.

[/trans]

Strategy Arguments

| Argument | Default | Description |

|---|---|---|

| v_input_string_1 | 0 | Select Trading Direction: Both |

| v_input_int_1 | 21 | (?RMI Settings)RMI Length |

| v_input_int_2 | 70 | Positive Momentum Threshold |

| v_input_int_3 | 30 | Negative Momentum Threshold |

| v_input_int_4 | 30 | (?Momentum Settings)Band Length |

| v_input_int_5 | 20 | RWMA Length |

| v_input_int_6 | 10 | (?Super Trend Settings)Super Trend Length |

| v_input_timeframe_1 | 480 | Higher Time Frame |

| v_input_float_1 | 3.5 | Super Trend Factor |

| v_input_string_2 | 0 | MA Source: WMA |

| v_input_bool_1 | true | (?Visual Settings)Display Range MA |

| v_input_color_1 | #00bcd4 | Bullish Color |

| v_input_color_2 | #ff5252 | Bearish Color |

Source (PineScript)

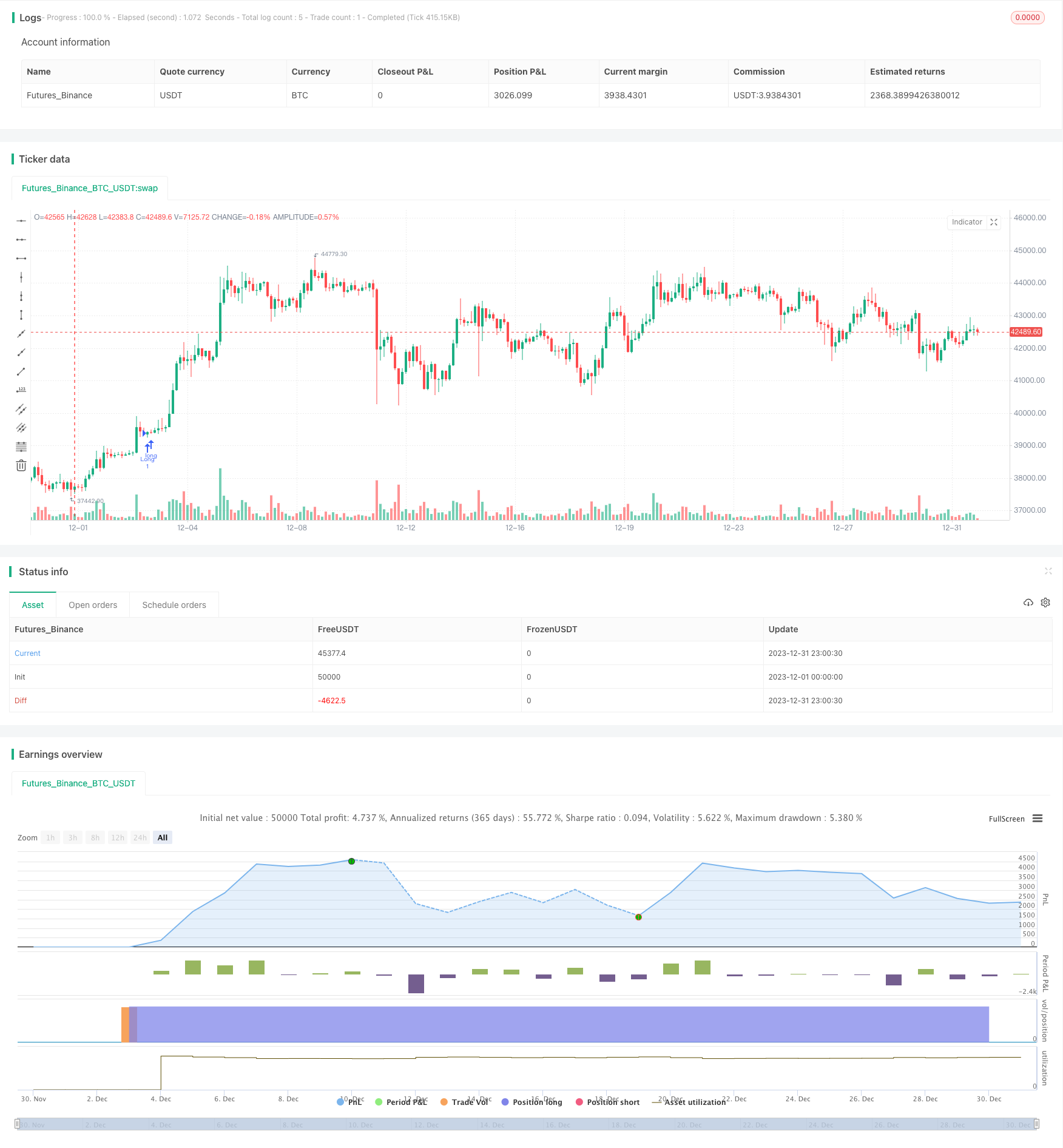

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// @ presentTrading

//@version=5

strategy("RMI Trend Sync - Strategy [presentTrading]", shorttitle = "RMI Sync [presentTrading]", overlay=true )

// ---> Inputs --------------

// Add Button for Trading Direction

tradeDirection = input.string("Both", "Select Trading Direction", options=["Long", "Short", "Both"])

// Relative Momentum Index (RMI) Settings

Length = input.int(21, "RMI Length", group = "RMI Settings")

pmom = input.int(70, "Positive Momentum Threshold", group = "RMI Settings")

nmom = input.int(30, "Negative Momentum Threshold", group = "RMI Settings")

bandLength = input.int(30, "Band Length", group = "Momentum Settings")

rwmaLength = input.int(20, "RWMA Length", group = "Momentum Settings")

// Super Trend Settings

len = input.int(10, "Super Trend Length", minval=1, group="Super Trend Settings")

higherTf1 = input.timeframe('480', "Higher Time Frame", group="Super Trend Settings")

factor = input.float(3.5, "Super Trend Factor", step=.1, group="Super Trend Settings")

maSrc = input.string("WMA", "MA Source", options=["SMA", "EMA", "WMA", "RMA", "VWMA"], group="Super Trend Settings")

atr = request.security(syminfo.tickerid, higherTf1, ta.atr(len))

TfClose1 = request.security(syminfo.tickerid, higherTf1, close)

// Visual Settings

filleshow = input.bool(true, "Display Range MA", group = "Visual Settings")

bull = input.color(#00bcd4, "Bullish Color", group = "Visual Settings")

bear = input.color(#ff5252, "Bearish Color", group = "Visual Settings")

// Calculation of Bar Range

barRange = high - low

// RMI and MFI Calculations

upChange = ta.rma(math.max(ta.change(close), 0), Length)

downChange = ta.rma(-math.min(ta.change(close), 0), Length)

rsi = downChange == 0 ? 100 : upChange == 0 ? 0 : 100 - (100 / (1 + upChange / downChange))

mf = ta.mfi(hlc3, Length)

rsiMfi = math.avg(rsi, mf)

// Momentum Conditions

positiveMomentum = rsiMfi[1] < pmom and rsiMfi > pmom and rsiMfi > nmom and ta.change(ta.ema(close,5)) > 0

negativeMomentum = rsiMfi < nmom and ta.change(ta.ema(close,5)) < 0

// Momentum Status

bool positive = positiveMomentum ? true : negativeMomentum ? false : na

bool negative = negativeMomentum ? true : positiveMomentum ? false : na

// Band Calculation

calculateBand(len) =>

math.min(ta.atr(len) * 0.3, close * (0.3/100)) * 4

band = calculateBand(bandLength)

// Range Weighted Moving Average (RWMA) Calculation

calculateRwma(range_, period) =>

weight = range_ / math.sum(range_, period)

sumWeightedClose = math.sum(close * weight, period)

totalWeight = math.sum(weight, period)

sumWeightedClose / totalWeight

rwma = calculateRwma(barRange, rwmaLength)

colour = positive ? bull : negative ? bear : na

rwmaAdjusted = positive ? rwma - band : negative ? rwma + band : na

max = rwma + band

min = rwma - band

longCondition = positive and not positive[1]

shortCondition = negative and not negative[1]

longExitCondition = shortCondition

shortExitCondition = longCondition

// Dynamic Trailing Stop Loss

vwma1 = switch maSrc

"SMA" => ta.sma(TfClose1*volume, len) / ta.sma(volume, len)

"EMA" => ta.ema(TfClose1*volume, len) / ta.ema(volume, len)

"WMA" => ta.wma(TfClose1*volume, len) / ta.wma(volume, len)

upperBand = vwma1 + factor * atr

lowerBand = vwma1 - factor * atr

prevLowerBand = nz(lowerBand[1])

prevUpperBand = nz(upperBand[1])

float superTrend = na

int direction = na

superTrend := direction == -1 ? lowerBand : upperBand

longTrailingStop = superTrend - atr * factor

shortTrailingStop = superTrend + atr * factor

// Strategy Order Execution

if (tradeDirection == "Long" or tradeDirection == "Both")

strategy.entry("Long", strategy.long, when = longCondition)

strategy.exit("Exit Long", "Long", when=longExitCondition, stop = longTrailingStop)

if (tradeDirection == "Short" or tradeDirection == "Both")

strategy.entry("Short", strategy.short, when =shortCondition)

strategy.exit("Exit Short", "Short", when=shortExitCondition, stop = shortTrailingStop)

Detail

https://www.fmz.com/strategy/438930

Last Modified

2024-01-16 14:10:25